|

|

EAP

Newsletter November 2002

edited by airtraffic promotion

group

(no official newsletter of

EuroAirport Basel-Mulhouse-Freiburg)

Monthly news coverage of the

only tri-national airport Basel-Mulhouse-Freiburg - Regio TriRhena

Features

of the month

Champions

League at its best - Swiss Codeshares - Travel preferences of

business flyers - Airport accessability benchmarking - Regionals at

a crossroad - October 2002 statistics - charter and scheduled news

>>

download (MS Word)

Photo: Andrew Hunt

NEWS

DESERT TEAM is definitely switching partners for its Algerian charter. The contract will go to Khalifa Airways instead which is ready to start with a Boeing B-737-400 on December 22. The routing is Basel - Djanet - Tamanrasset - Basel vv. every Sunday.

AERIS FLIGHTS EAP - PARIS vv. are now open to the local market. In the first phase 150 and later on up to 450 seats are available each way. Initial fares are at 6.80 Euro plus airport tax of 15 Euro. The carrier operates three weekly flights ex Paris via EAP to Puerto Plata, La Romana and Malé. www.hopla.fr

Swiss Federal Office of Civil Aviation responded to our (PrivateAir shuttle to NYC) questions as follows :

as LH-flight, Swiss carriers must issue no objections. Germany is to grant mutual rights to Swiss carriers.

as PrivatAir charter, traffic rights are required as the "Open Sky agreement" does not cover charter works.

as AF-flight, French traffic rights ex MLH are required.

as flight of US-carriers, the "Open Sky agreement" is setting the framework for such deals.

PrivateAir's basic plan is to place its BBJ fleet either with airlines and/or corporate travel

organizations.

AIR FRANCE started to increase seat capacity to Paris-Orly, departing from the present 4 : 3 aircraft mix (A-319/A-320) on November 4. The new mix is now 5 A-320, 1 A-321 and 1 A-319 a day. Available seats are at 1'125 a day (+80) and 47'250 a week (+3'360). There are 42 flights a week in each direction.

Star Alliance parter AIR CANADA (AC) launched a sales drive for Toronto flights which are codeshared with LH ex Munich and Frankfurt. Air Canada can also be booked ex EAP.

Photo: Rolf

Keller

CHAMPIONS LEAGUE AT ITS BEST

The EAP and its fan community had their share of fan-charters lining up for take-off to Glasgow, Liverpool and Valencia.

Since the FC Basel started its Champions League ride a total of 28 charters added as much as 8'500 passengers to the EAP's July thru November statistics. Here is a first look what has happened sofar.

month carrier aircraft destination pax

(based on round-trip and full load)

08/2002

SWISS S20 Bratislava 100

SkyEuro EMB120 Bratislava 60

SWISS ARJ1 to Glasgow 180

SWISS MD83 to Glasgow 320

SWISS MD83 to Glasgow 320

SWISS A320 to Glasgow 300

Belair B767-3 to Glasgow 520

Titan B737-3 from Glasgow 300

09/2002

SWISS A330-2 to Liverpool 450

SWISS A321 to Liverpool 360

SWISS MD83 to Liverpool 320

SWISS MD83 to Liverpool 320

SWISS MD83 to Liverpool 320

AirLib DC10-30 to Liverpool 660

Neos B737-8 to Liverpool 400

Eurowing A319 to Liverpool 280

ALine400 TU154M from Moscow 320

10/2002

SWISS MD83 to Valencia 320

SWISS MD83 to Valencia 320

SWISS MD83 to Valencia 320

Belair B757-2 to Valencia 420

Farnair ATR42 to Valencia 90

Neos B737-8 to Valencia 400

Futura B737-4 from Valencia 340

11/2002

SWISS MD83 to Moscow 320

SWISS MD83 to Moscow 320

Titan B737-3 from Liverpool 300

La Coruna, Manchester and Turin are next to come.

TRAVEL PREFERENCES OF BUSINESS FLYERS in the EAP catchment area surveyed by the Institute of Econometrics WWZ at the University of Basel

In Spring 2001, the chambers of commerce in the tri-national catchment area of the EAP launched a new research to study travel preferences of corporate business. Those companies responding are offering 124'000 jobs which represent 25% of total employment in Alsace (Colmar/Mulhouse), Southern Germany (Freiburg/Konstanz) and Switzerland (Greater Basel area).

following are some excerpts of the study.

number of business trips

98% of all companies registered a total of 120'000 travels to major destinations.

Travel activity varies substantially when looking at different sectors. Agro, pharma, chemicals, machinery and tooling, the service industries (banking, accounting, shipping) are known for its high demand for travel solutions.

In 1987, 185 trips per company were reported. In 2000, the numbers climbed to 420 trips per entity.

Recent economic development have left their marks on further increases in travel activity anticipated by the business community. 42% of companies expected a growing demand in air travel.

| selecting airports |

reasons not to choose the EAP |

|

|

60% ex EuroAirport

20% ex Zürich

11% ex Stuttgart |

destination not offered, departure time not suitable,

pricing by carrier ex EAP, congested road access ex

Switzerland and missing rail access as sub-optimal. |

Business travel ex EuroAirport is up sharply due to improved air services.

| important destinations |

more competition expected to/from |

|

|

| Amsterdam, Berlin, Brussels,

Frankfurt, Manchester, Paris,

London |

Amsterdam, Berlin, Düsseldorf, Hannover,

London, Munich, Paris with better pricing |

| air-links JFK - BSL is a

high priority, services to

Atlanta, Chicago running second |

rail and road networks in competition

to air services within a range of 300 km or with good train services (Hamburg, Milan) |

| reliability in the air

was quoted a major problem in

2000/2001. Flights ex EAP

seemed to suffer more so than at other airports. |

incoming business traffic

pattern: 58% of all companies receive guests from Europe and the NAFTA-zone, ex France/Germany =

30%, ex Britain and the NAFTA-zone =20%

most visitors are ex London, Paris, New York |

PS : Frankfurt and Munich services have been improved (seat capacity & flights).

Photo: Chris Waser

SWISS concluded three codeshare standards with six European carriers and American Airlines (also in place ex

EuroAirport).

| carrier |

codeshare standard |

to/from destination |

range of destination via hub |

| Aer Lingus |

free flow |

via London City |

to/from Dublin |

| American Airlines |

free flow |

via Brussels |

to/from Chicago |

| British Airways |

hard block (50

seats) |

via London Heathrow |

local traffic and worldwide |

| Finnair |

free flow |

via Helsinki |

local

traffic, domestic services in Finland |

|

|

via Basel |

to/from

Berne, Geneva, Lugano, Zürich |

| Iberia |

free flow |

via Barcelona |

local

traffic, domestic services in Spain |

|

|

via Madrid |

local

traffic, domestic services in Spain |

| Portugalia |

soft block |

Lisbon/Oporto |

local traffic |

| SN Brussels Airlines |

free flow |

via Brussels |

local

traffic, to/ex Bristol, Cardiff, Copenhagen, Gothenborg, Helsinki, Manchester,

Newcastle, Oslo to Kinshasa and from Monrovia |

definition : Hard Block (fixed number of seats on each flight & direction) Soft Block (seat allocation varies daily and weekly), Free Flow (first booked, first

confirmed)

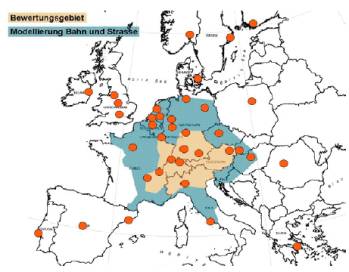

THE QUALITY OF ACCESS OF REGIONS by means of transportation is another benchmarking project engineered by BAK Economics Basel starting with Phase One indicators "intercontinental and inter-regional access" in November 2002. A first report is scheduled for June 2003.

BAK established procedures which will help to secure access to valuable data about all regions under review. Also, scientific standards have been set up to judge and interpret the data collected.

The team will look at centers like Basel, Frankfurt, Geneva, Lyon, Milan, Munich, Stuttgart, Vienna and Zürich with three indicators under consideration :

INTRA-REGIONAL ACCESS for highly-qualified manpower within a 60-minute radius to the particular ecenomic center.

REGIONAL POSITIONING (market access for clients, suppliers, business partners and for company support)

AVERAGE TIME SPENT BY AIR to reach intercontinental metropolis in the US and Canada, Latin America, Southern Africa, Australia and Southeast Asia.

Initial funding has been cleared with the Office of Urban Development (Amt für Raumplanung), Swiss Economic Council (seco), Swiss regions (Greater Basel Area) and with SWISS.

Other sources may be the (rail) networks DB (Germany), FS (Italy), OeBB (Austria), SBB (Switzerland), SNCF (France).

For each phase 250'000 CHF or 170'000 Euro are necessary to start the research. Any additional region to be considered would require new funding. WWZ of Basel and IRE of Lugano are particpating as scientific project consultants. Bewertungsgebiet = regions under review, all means of transportation

Photo: Chris Waser

THE LATEST EAP FIGURES FOR OCTOBER 2002

are showing slight improvements to last year's grounding disaster of Swissair.

Scheduled traffic is at 224'379 passengers, - 6% (in October 2001 -13%).

Charter traffic is at 56'987 passengers, - 3% (in October 2001 - 24%).

Total traffic is at 281'647 passengers, - 8% (in October 2001 - 15%).

ExpressCargo recorded 2'149 tons, + 7% (in October 2001 + 6%).

Commercial movements posted 7'696 landings and take-offs, - 7% (in October 2001 - 10%).

Traffic BSL - ZRH is basically zero. A local ATC strike pushed figures further down in October 2001.

REGIONALS ARE AT A CROSSROAD ! If one looks at their actual plight, perspectives are not good. ERA identified a heavy agenda of problems and setbacks to be faced.

1st economic recession is evident with no turnaround

2st the squeeze between low cost and flagcarriers.

3ndniche-markets (second tier-routes) are in question

4rd customers feel less inclined to pay exorbitant fares

5th EC mandated carriage contracts add extra costs

6th lacking clout at EC levels leaves the sector ad odds

7th still rising airport and atc costs reduce profitability

8th above factors may push the end of 50-seater-ops.

PS : SWISS faces more problems to operate the Embraers profitably. The airline failed to keep its costs in line when it took on the role as intercontinental carrier. The management is putting together a cost-cutting plan to save the businessplan

with 26/26 medium and longrange aircraft.

Clouded outlooks for ERA member airlines may pave the way to re-invent regional traffic.

Pressure is mounting to look at air-travel in a different manner - life-style attitudes are on the way out. Flying is being reduced to a necessary commodity at generally lower fares !

Dear Editor, IS GENERAL AVIATION A NOBODY ?

I miss general aviation as topic in the newsletter. This sector is getting little attention by the airport. Coping with poor infrastructure and high fees does hardly forster a positive business climate. c.moser

AIRTRAFFIC PROMOTION GROUP, WANDERSTRASSE 77, 4054 BASEL - TEL./FAX. ++41 61 302 5775 / E-MAIL.

EAPNEWS@HOTMAIL.COM

back to

top

|